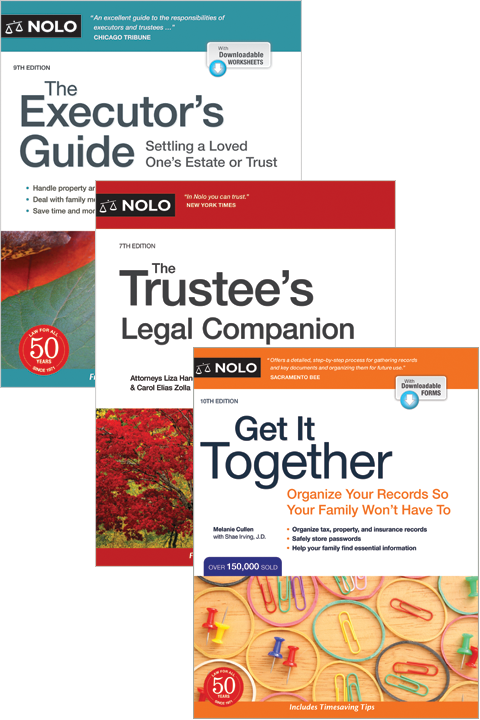

Nolo's Executor's Bundle

- Bundle Products

- Executor FAQs

- Both are in charge of assets that belonged to a deceased loved one. They both have what’s called a fiduciary duty to act honestly and in the best interests of the people who inherit those assets.

- Both must gather and safeguard assets, pay debts and taxes, and distribute what’s left to the people or organizations that inherit under the terms of the will or trust.

- Both must keep careful records of how estate or trust funds are spent and how assets are distributed.

What’s the difference between an executor and a trustee?

An executor is named in a will; after the will-maker’s death, the executor must take charge of the deceased person’s assets and follow the instructions in the will. The successor trustee of a probate-avoiding living trust is named in a trust document and is responsible for managing assets that the deceased person held in the trust.

There are many similarities in the jobs of executors and trustees:

The executor is in charge of assets that pass under the will. These assets make up what’s called the “probate estate.” A trustee has authority only over assets that were held in the name of the trust.

Do I have to serve as executor or trustee if I’ve been named in a will or trust?

No; you can decline to serve. If you decide not to accept the job, and the will or trust names an alternate executor or trustee, that person is next in line to serve. If there’s no alternate, the probate court will have to choose someone, following the priority list set out in state law.

Does a court have to approve my appointment as executor or trustee?

Yes, if you’re an executor; no, if you’re a trustee.

A probate court generally appoints as executor whomever is named in the will, unless there’s an obvious reason for disqualification. When the court approves the executor, it issues a document (commonly called “Letters Testamentary” or a similar title) that gives the executor authority over estate assets.

A trustee, however, is not approved or supervised by a probate court. The trustee’s authority comes from the trust document itself.

When do an executor’s duties begin?

An executor named in a will has no responsibilities until after the death of the person who wrote the will. Then, the prospective executor goes to the probate court and requests to be appointed as executor of the estate.

Generally, a successor trustee also takes over after the death of the person who created the trust. Most living trusts, however, provide that the successor trustee can take over management of trust assets if the original trustee (the person who created the living trust) becomes incapacitated.

If there’s no will, who serves as executor of an estate?

If the deceased person didn’t leave a will, or if the executor named in the will is unable or unwilling to serve, the court appoints someone to be in charge of the estate. In most states, this person is called an administrator instead of an executor, but the job is exactly the same. In some states, the person in charge is called the personal representative of the estate, whether or not there is a valid will.

Are executors and trustees paid for their work?

They can be. Executors and trustees are entitled to reasonable compensation, which is usually calculated according to a formula provided by state law or simply required to be reasonable under the circumstances. Many executors and trustees don’t accept payment, in part because it’s taxable income. Inherited money, by contrast, is not taxable income.

Do I need a lawyer to help me with probate or distributing trust assets?

It depends on your situation. Many estates don’t go through probate at all because the deceased person owned all valuable property jointly with another person or had designated beneficiaries to inherit it outside of probate. For example, most people designate beneficiaries for their retirement accounts, so those accounts don’t need to go through probate.

If the estate goes through formal probate, most executors benefit from the advice of an experienced probate lawyer. And you’ll certainly need a professional’s help if there’s a will contest (this is very rare) or other dispute with beneficiaries or creditors.

If you’re the trustee of a simple living trust, you may be able to wrap up the trust without a lawyer’s help. Seek legal counsel if you have questions about taxes, debts, or disputes.

-

Useful books - great price!

-

I ordered these for my role as my mother's executor and trustee. One improvement that they could have made is some example trust accounting spreadsheets, but other than that I find the information very complete so far.

Posted on 11/2/2021

-

Excellent How-To

-

I read the Executor's Guide from our local library, the book had so much helpful information, I ordered both it and the Trustee's Legal Companion for myself, I feel confident my daughter will be able to handle my Trust on her own with the information in these books. I myself as my husbands successor Trustee will also be able to take care of the details of his Trust if he predeceases me.

Posted on 12/1/2019

-

Informative process, procedure, examples for: grantor, trustee, grantor, beneficiary

-

Great resource in one book and ordered. Glad the 3 came as a bundle. They compliment each other. The named trustee and/or executor in a Trust/Will should be provided these references.

Posted on 4/19/2017